By Andrew Weaver

If you are opening a new quilting business, Section 179 of the IRS tax code can boost cash flow in your first year and make it easier for you to get the equipment you NEED to be a success!

Section 179 incentivizes businesses to purchase, finance or lease qualifying equipment. It allows businesses to deduct the full amount of the purchase price of equipment in the first year, rather than having to depreciate the equipment over several years.

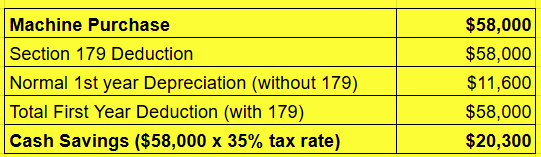

If you FINANCE your Gammill machine, Section 179 savings on your tax bill (or refund increase) could exceed total monthly payments in your first year of ownership! Here is a sample of how this could apply to a purchase in 2025:

Source: www.section179.org

By applying Section 179 in this example, you have $20,300 taken right off your tax bill or straight into your IRS refund check.

Example:

- Order your Gammill for delivery before Dec. 31, 2025

- Finance your machine through one of the lenders on our site (or any other lender)

- Receive your IRS refund or Tax Credit of $20,300 in February or March 2026 (depend on filing speed)

- From a cash-flow perspective, you’ve only made a few monthly payments on your machine but you have received a huge cash infusion from the IRS.

When starting a business, cash flow is important! The IRS provides this incentive to make it easier for businesses to buy the equipment they need in order to keep the economy humming.

How much can I deduct?

For 2025, the limit is $1,250,000 or your business income, whichever is less. If income is under $1,250,000, offset all 2025 income and carry forward unused amount. Phase-out starts at $3,130,000 in purchases. Congress may adjust late-year; check updates.

Consult your tax advisor.

What is my deadline to get in on this?

You should talk to your Gammill Advisor right away! . In order to qualify for the Section 179 Deduction of $25,000, the equipment must be put into service (delivered) by December 31.

Where can I get more information?

More information about Section 179 is available at www.section179.org. Please also remember to consult a tax professional for more information.